The customer invoices, credit notes, supplier invoices, payments and manual postings created in AbaNinja are immediately transferred to Abacus Financial Accounting and can be automatically posted there.

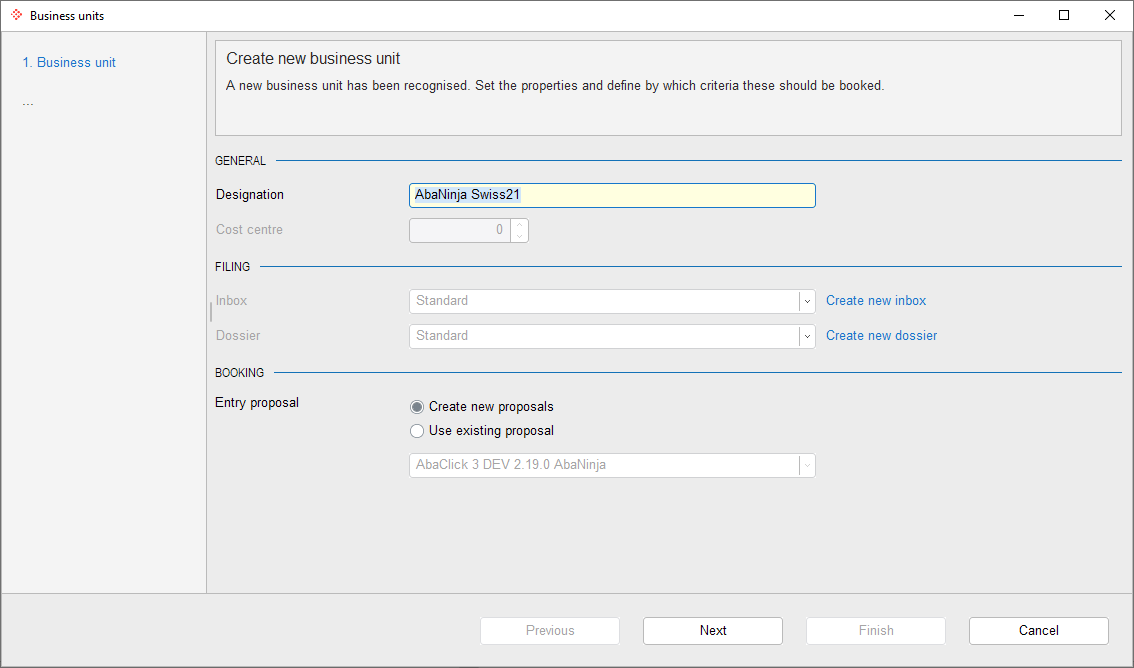

When processing a document for the first time, a wizard is started which guides you step by step through the individual settings.

Requirements

Please ensure that you have connected AbaNinja to Abacus Financial Accounting using the following instructions: How do I activate the connection to Abacus Financial Accounting?

We recommend working in AbaNinja with products and with manual positions only when absolutely necessary.

Please make sure that:

- in the program F621 Application settings under Financial accounting > General > Settings the document number is set alphanumeric (remove flag at "numeric").

- in program F621 Application settings under Financial accounting > Booking > Settings > Lead currency the "Amount 0.00 allowed" has been set.

- in the F6312 Company program, under Tax numbers, the "VAT left unrounded" has been entered.

- the Abacus client's VAT liability matches the AbaNinja account.

Process documents from AbaScan Inbox

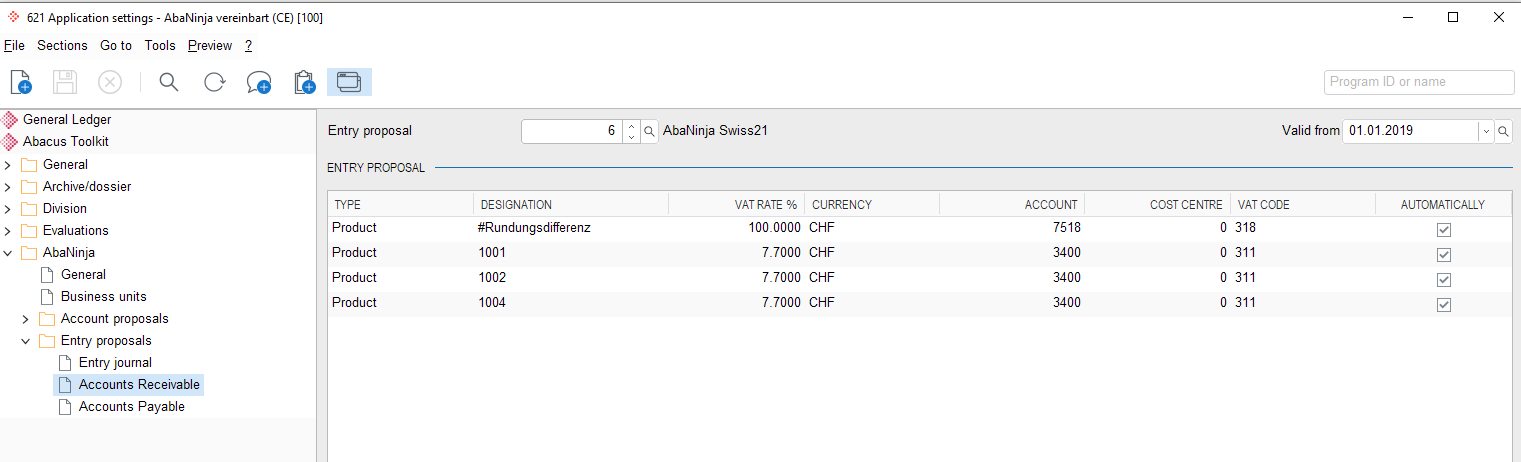

When a document is processed for the first time, an wizard is started which guides you step by step through the individual settings. All configurations and settings are stored in F621 Application settings and can be checked or modified there at any time.

- If a sample client is used, the existing proposal can be selected when creating the business unit, where a basic set of account proposals is already stored.

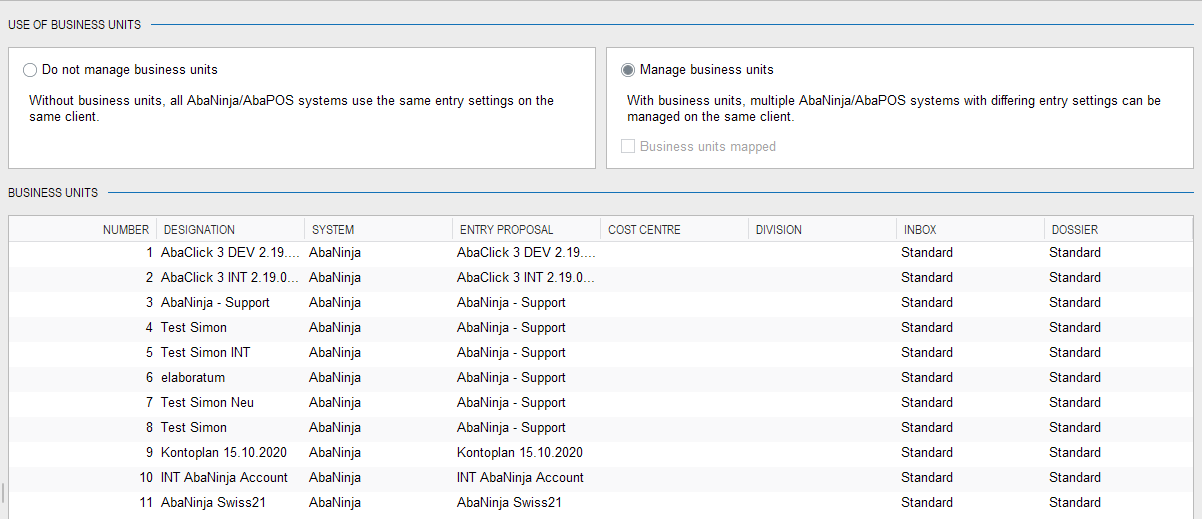

- As a rule, a simple fiduciary can work without business units. Business units are needed only when several AbaNinja accounts are to be linked to the same client.

- Different business units (i.e. AbaNinja accounts) can have either the same or a different update proposal.

- If you work with business units, you can also choose whether the individual AbaNinja systems should be managed as respective cost centers.

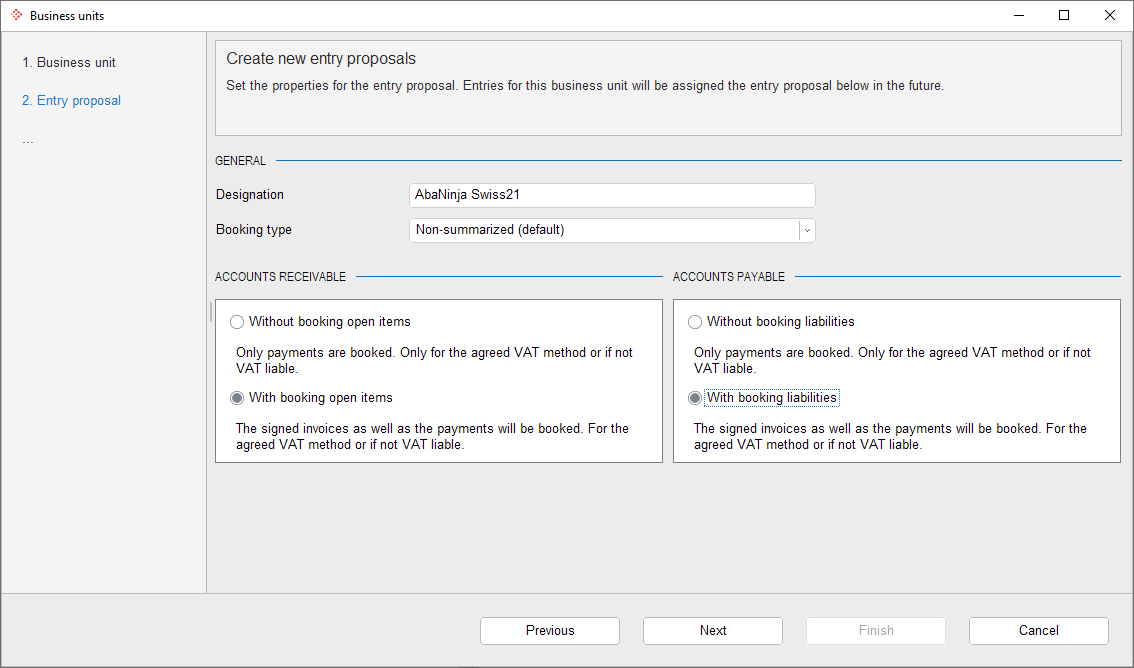

It is possible to define whether only the documents of payments (without open items, in case of collected VAT method) or additionally the invoices (with open items, in case of agreed VAT method) should be processed. This setting cannot be changed afterwards.

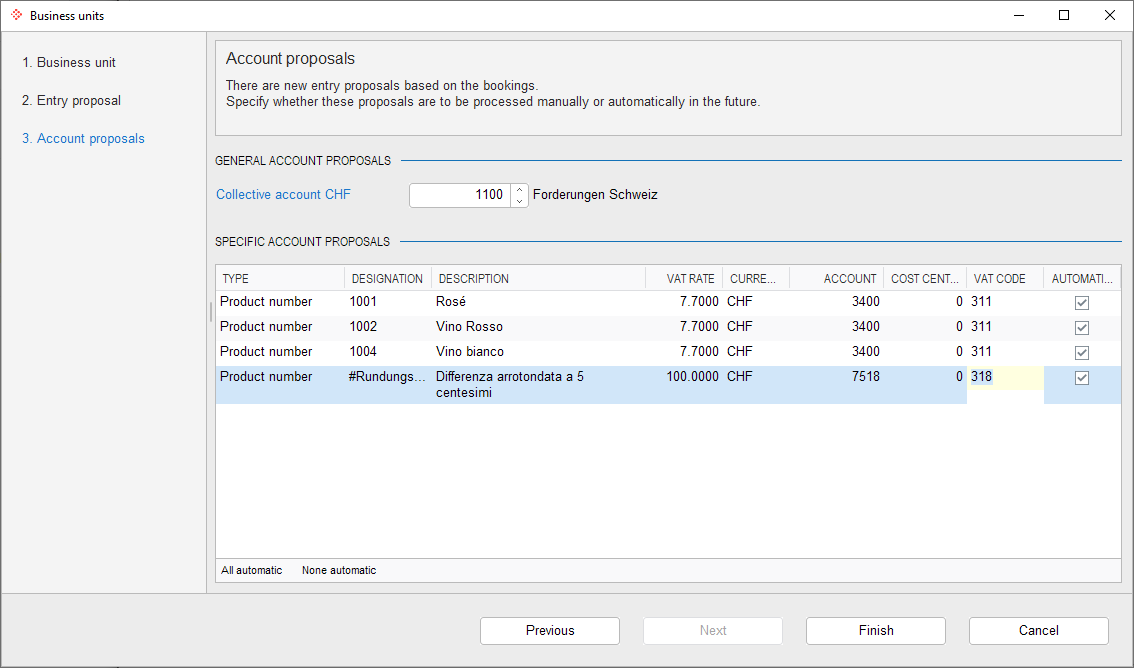

Automatic processing in Abacus always requires a unique assignment criterion:

- Debtors/Customers: Product number (accounting account for imported invoices).

- Creditors/Suppliers: Accounting account

For a product/account, one update proposal can also be entered for each VAT rate.

For each account proposal, you can decide whether the processing of the next document with this product/account should take place automatically or not. If the "Automatic" flag is not set, the next document with this product/account must be processed manually from the AbaScan Inbox.

These account proposals can be modified at any time in F621 Application settings.

Important:

One-off/manual items must always be entered manually, as no clear allocation criterion is possible for this.

Program F11 Entry mask

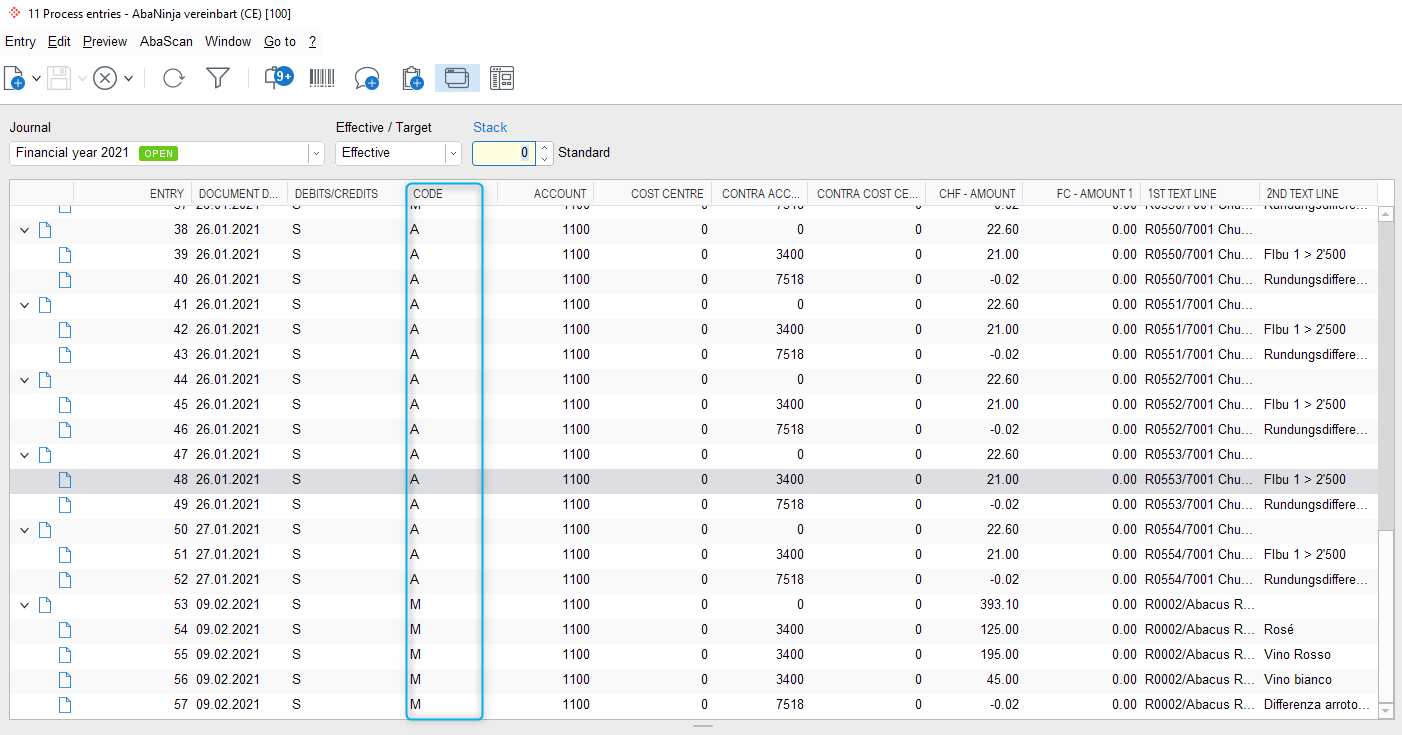

Entries that have been processed automatically are marked in F11 (code M, A). This makes it possible to create an exact evaluation of how many entries were processed manually or automatically.

If the user changes something in the previously made account proposals (e.g. account, cost center or VAT code) in program F11 after the wizard, the conflict dialog appears when the entry is saved. There the user can specify or the change was a one-time occurance, or whether the proposal should be saved for future entries.

After saving in F11 (collective entries are saved with Ctrl-T or via grid footer action), the document disappears from the inbox and is placed in the dossier for the corresponding G/L entry.

Video tutorial

In the following video you will learn how to process AbaNinja documents from the AbaScan inbox in Abacus into the financial accounting (F11 Enter). You will also learn how to automate the processing and how to modify update proposals.

Webinar Abacus Connection

We regularly offer interested parties a webinar on Abacus connection and processing. This webinar is mainly aimed at fiduciaries and customers with an AbaWeb subscription.

More information: www.swiss21.org/webinare

Comments

0 comments

Article is closed for comments.