With the release of 09 December 2020, new features and improvements in the following areas have been implemented.

1. Invoice import - Reminders

2. Invoice import -External invoice number

3. Invoice import via e-mail

4. eBill invoice recipient search based on e-mail address

5. Outgoing payment QR invoice

6. Manually enter payments -tax rate

7. Reports - Balance sheet & Income statement

8. Chargeable expenses

9. Reimbursable expenses

10. Document Designer - VAT-No/ CID on the recipient's address

11. Stripe - Strong Customer Authentication (SCA)

Customers

1. Invoice import - Reminders

If customer invoices are imported from an external system and the reminder system is used within AbaNinja, the stored document design is now used for the reminder letter.

2. Invoice import - External invoice number

If an external invoice number is used when importing customer invoices, this number is now also displayed in all areas (dashboard, overview, reports, etc.).

3. Invoice import via e-mail

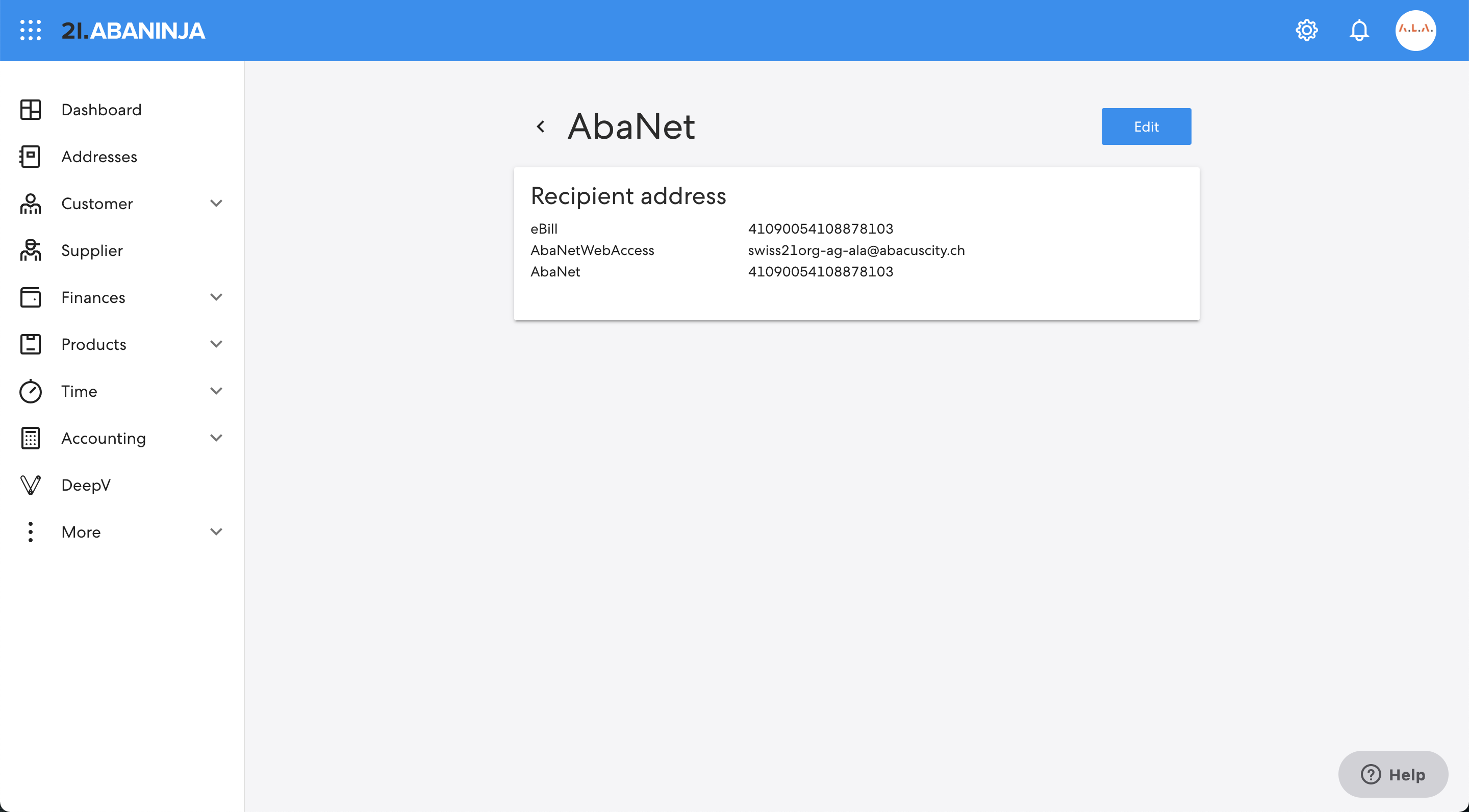

Users who generate invoices in an external system and import them into AbaNinja now have the option of automating this import through receipt by e-mail. To do this, the AbaNet module must be activated and a sender address for customer invoices must be defined in the settings.

If the invoice is now sent to the AbaNetWebAccess address from a external system or by e-mail from the stored sender, it is automatically saved as a draft under the customer invoices and not as a supplier document.

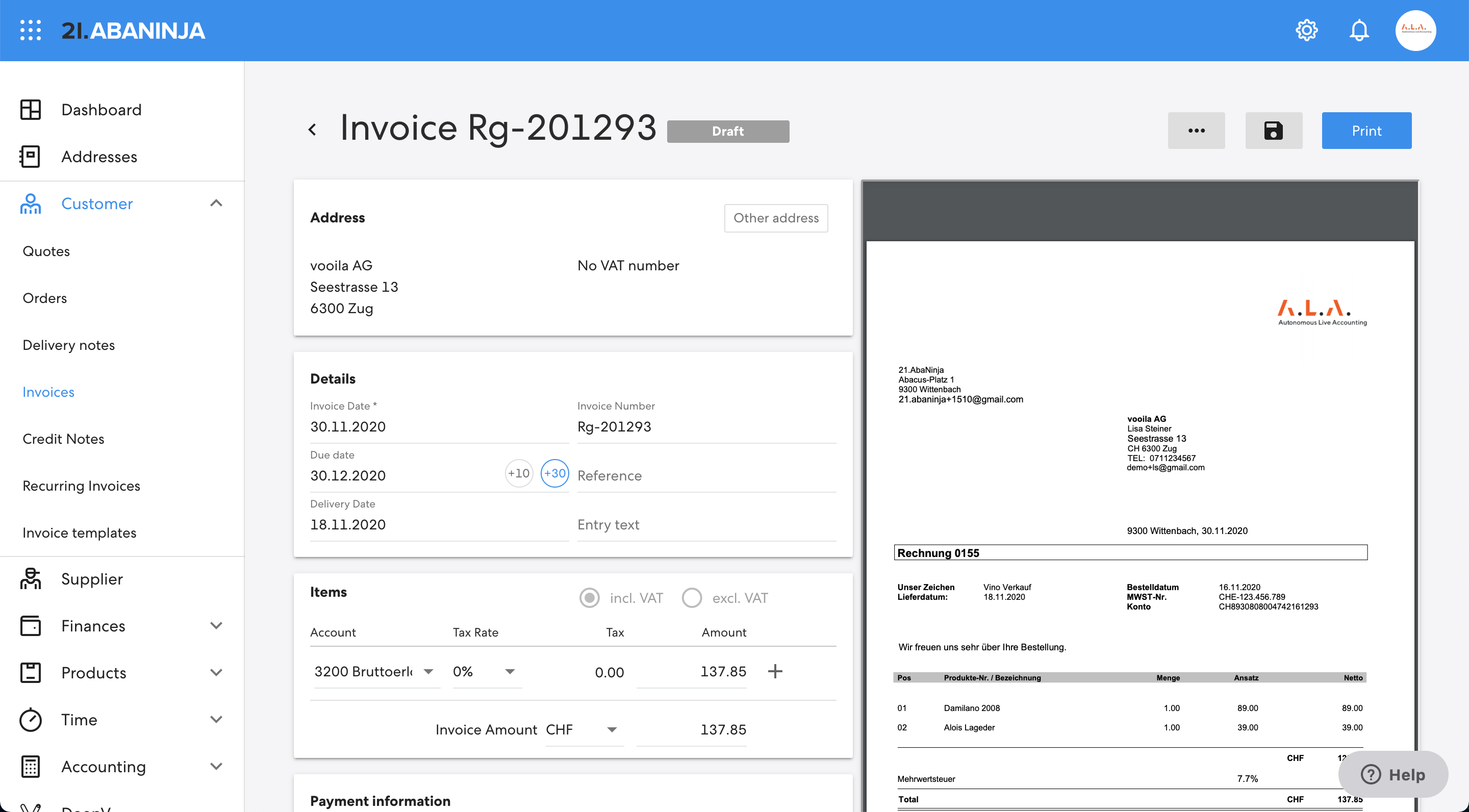

4. eBill - Search for invoice recipient based on e-mail address

This function is available to all users who have activated the AbaNet module and are connected as eBill invoicers. When creating an invoice, we verify by means of the e-mail address whether the recipient wishes to receive invoices as eBill. If they do, the invoices can be transmitted directly as eBill.

Finances

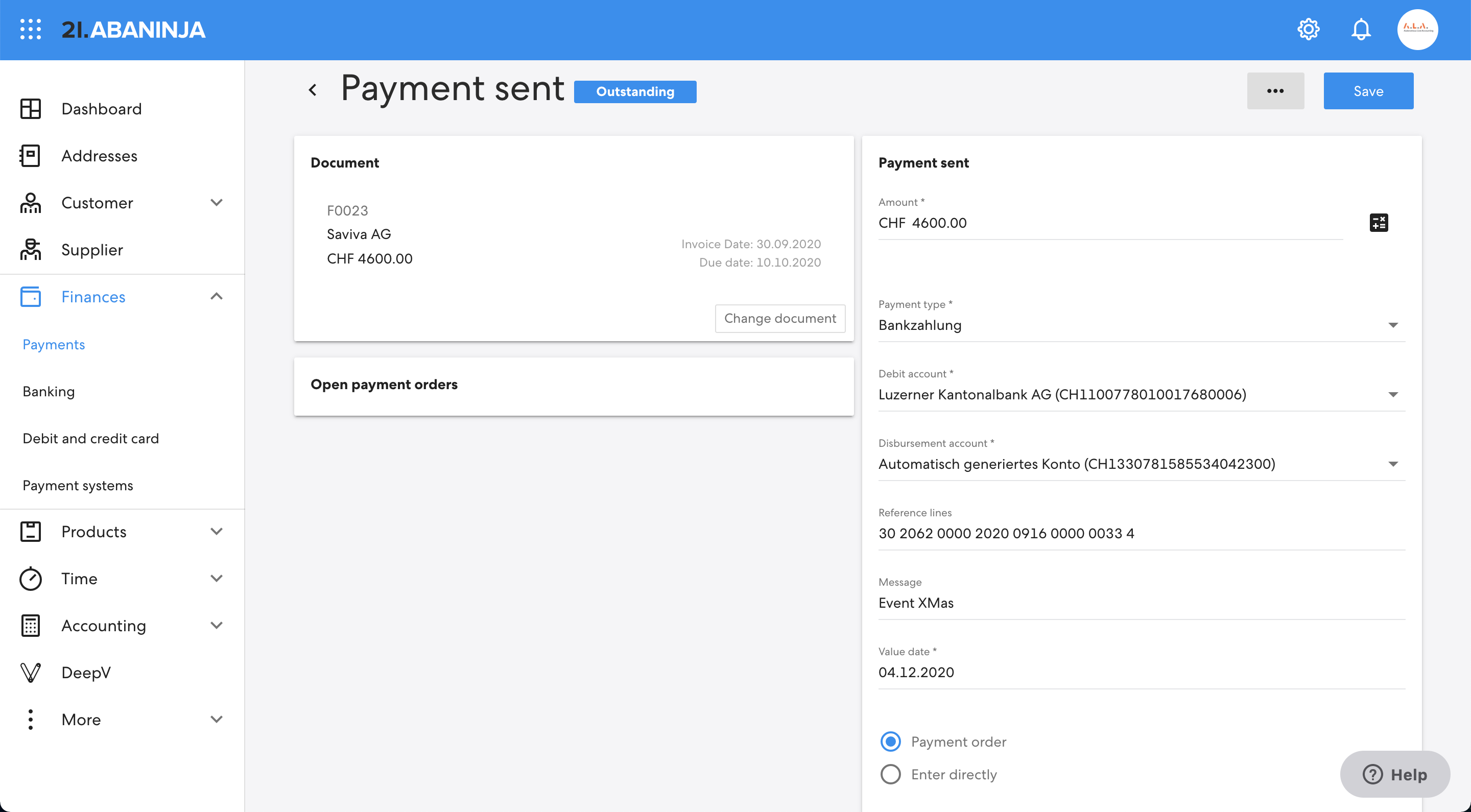

5. Payment by QR invoice

When paying QR invoices, it is now possible to enter a message text that is transmitted to the bank when the payment order is synchronised.

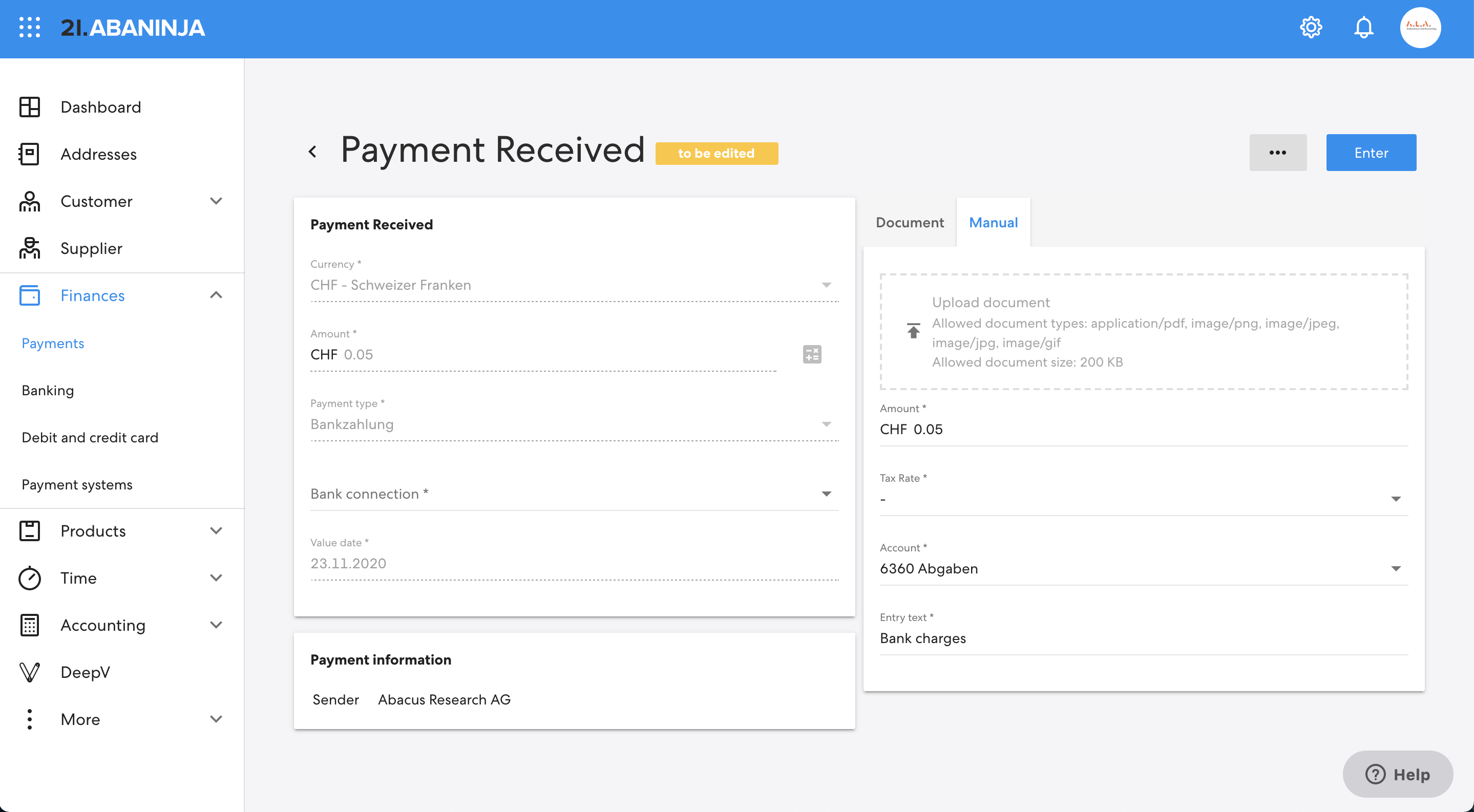

6. Manually enter payments - Tax rate

If payments are entered manually, now the tax rate can also be selected.

Accounting

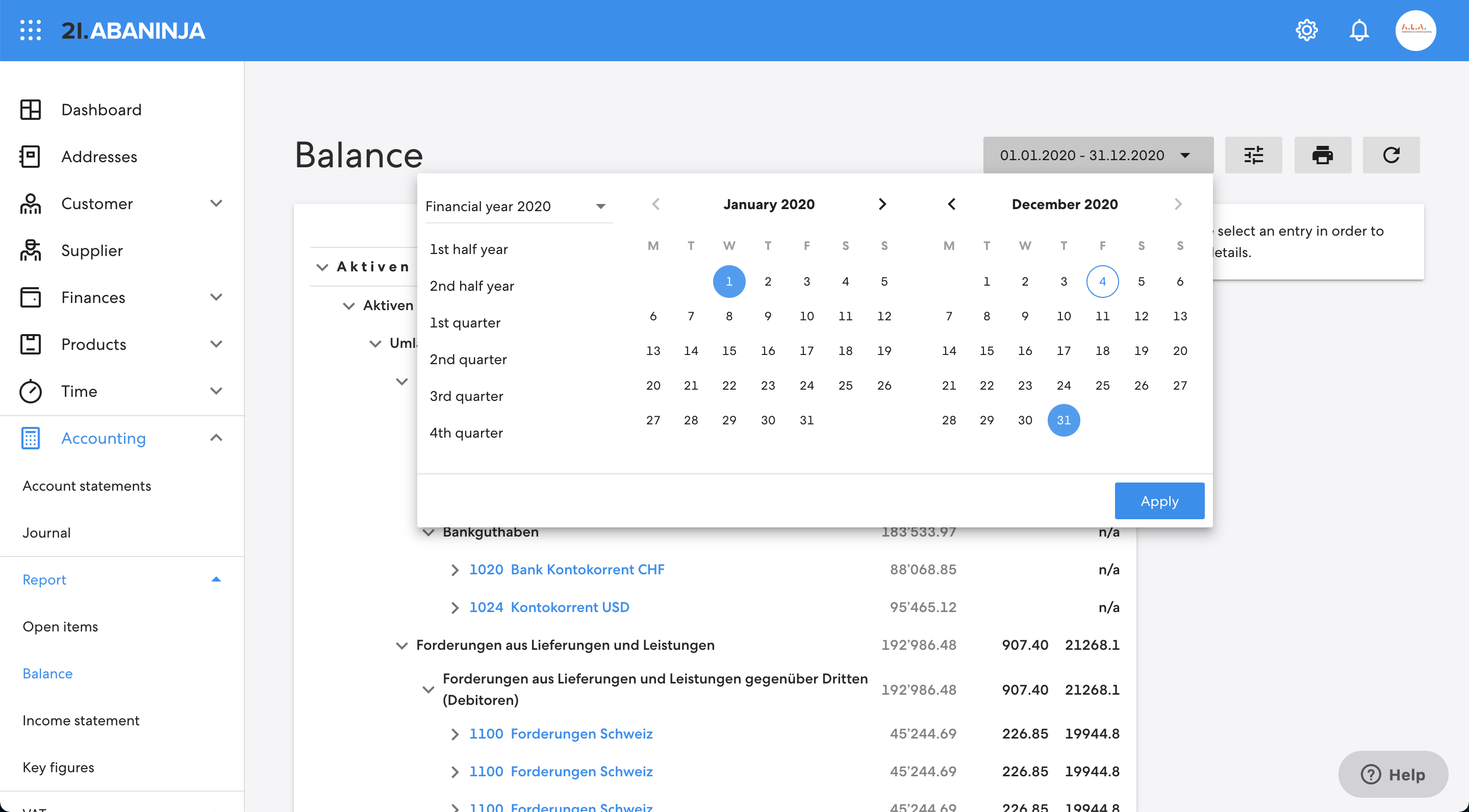

7. Reports - Balance sheet & Income statement

In the balance sheet and income statement reports, it is possible to narrow down within the financial year using predefined or individual time periods.

AbaClik

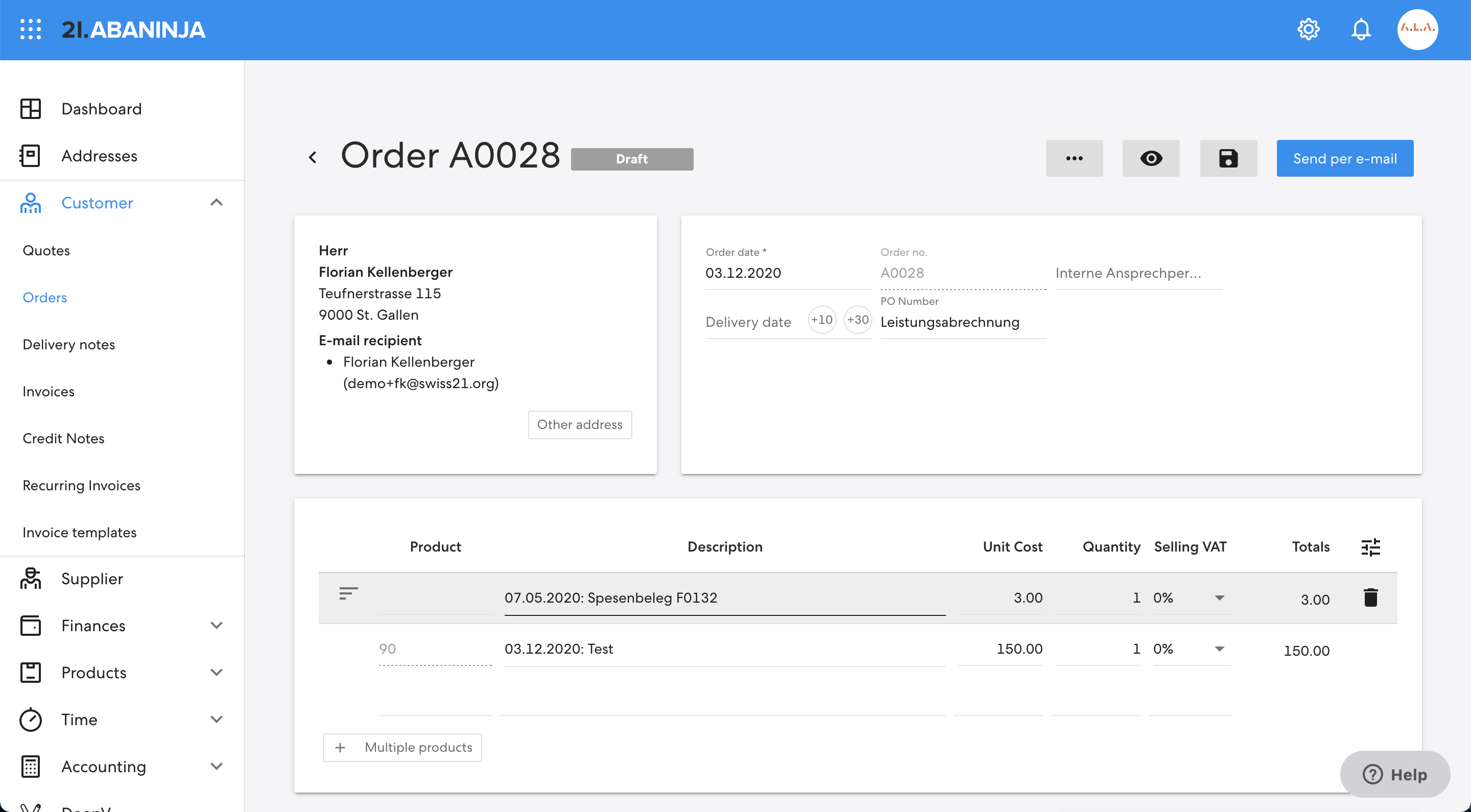

8. Chargeable Expenses

In the latest version of AbaClik3, you can specify when entering expense and invoice receipts if they should be charged to the client. If the option "chargeable" is used, a client must be selected.

In this case, one item per receipt is created in the customer's order. The expenses and services entered can then be invoiced to the customer as usual with just one click.

9. Reimbursable expenses

Documents paid by the employee in cash or with a private card can be reimbursed to the employee via the "reimbursable" option using a payment order. The prerequisite for this is that the employee is also entered as an address with bank details and is assigned to the employee in the time recording.

In AbaNinja, a payment order can be created from the document and then reimbursed to the employee as usual.

Settings

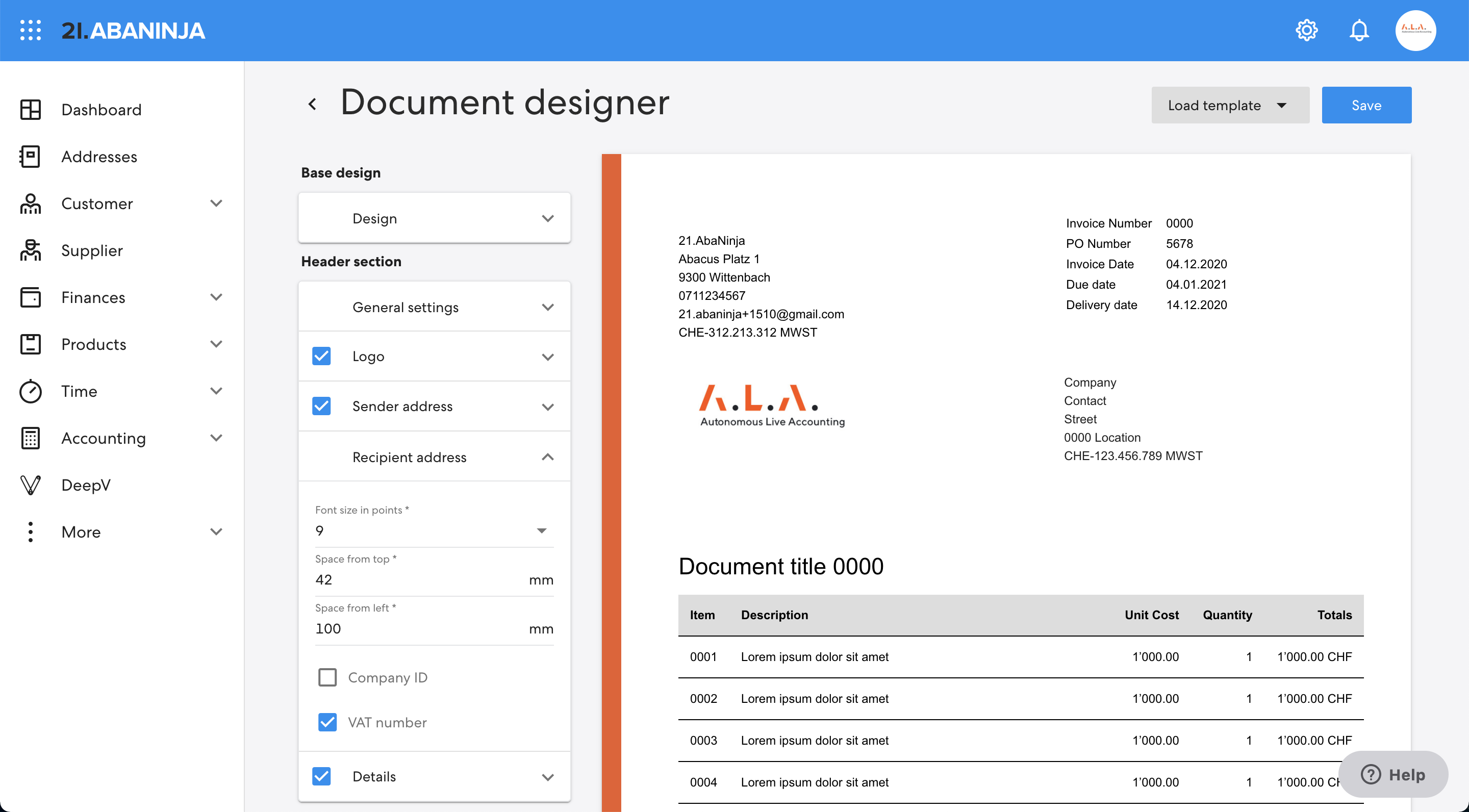

10. Document-Designer - VAT-No/ CID on the recipient's address

It is now also possible to show the VAT number or the CID on the recipient's address.

11. Stripe - Strong Customer Authentication (SCA)

In Europe, the legal regulations for online payments have been tightened in recent years. This is accompanied by new regulations requiring stricter authentication of customers (Strong Customer Authentication - SCA) when paying invoices by credit card. For this reason, we have updated our interface to Stripe.

Comments

0 comments

Article is closed for comments.