In the update of 22 September 2021, new features and improvements were implemented in the following areas.

Summary

Video about all new features

General

Dashboard

Customers

3. Address number on customer documents

Accounting

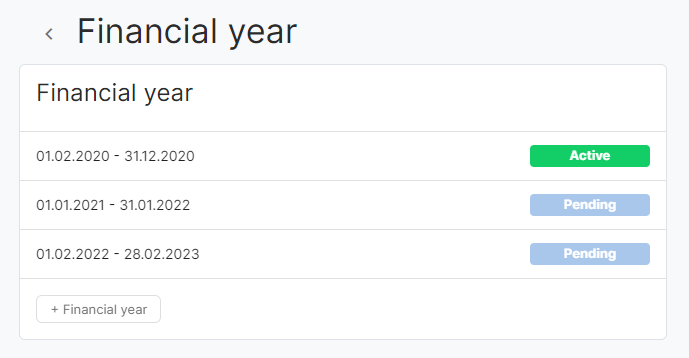

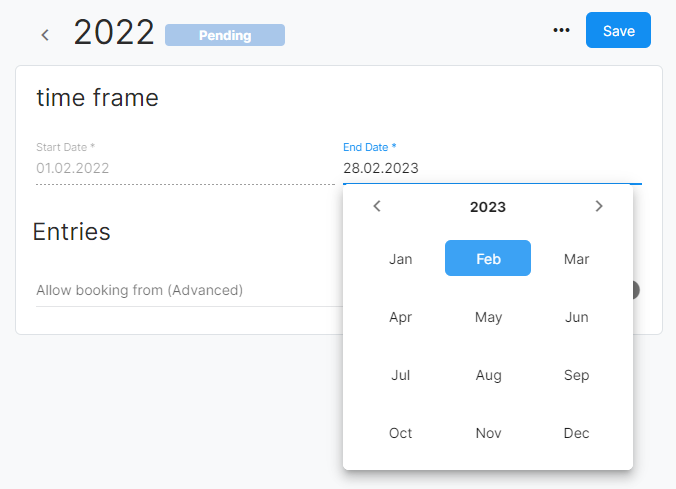

5. Financial year not equal to calendar year

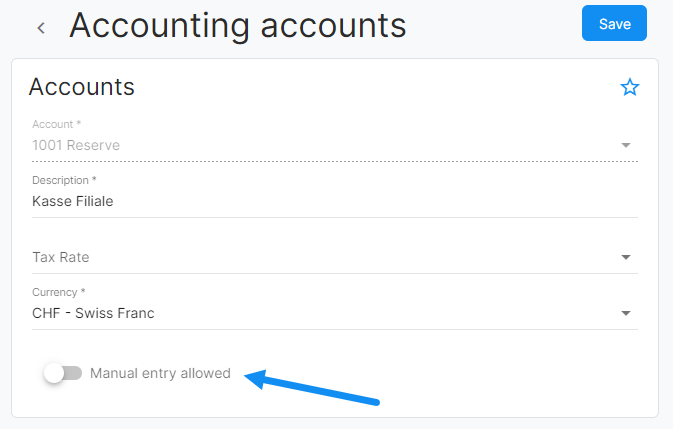

6. Accounting accounts: Allow or prevent manual entries

Summary

Video about all new features

General

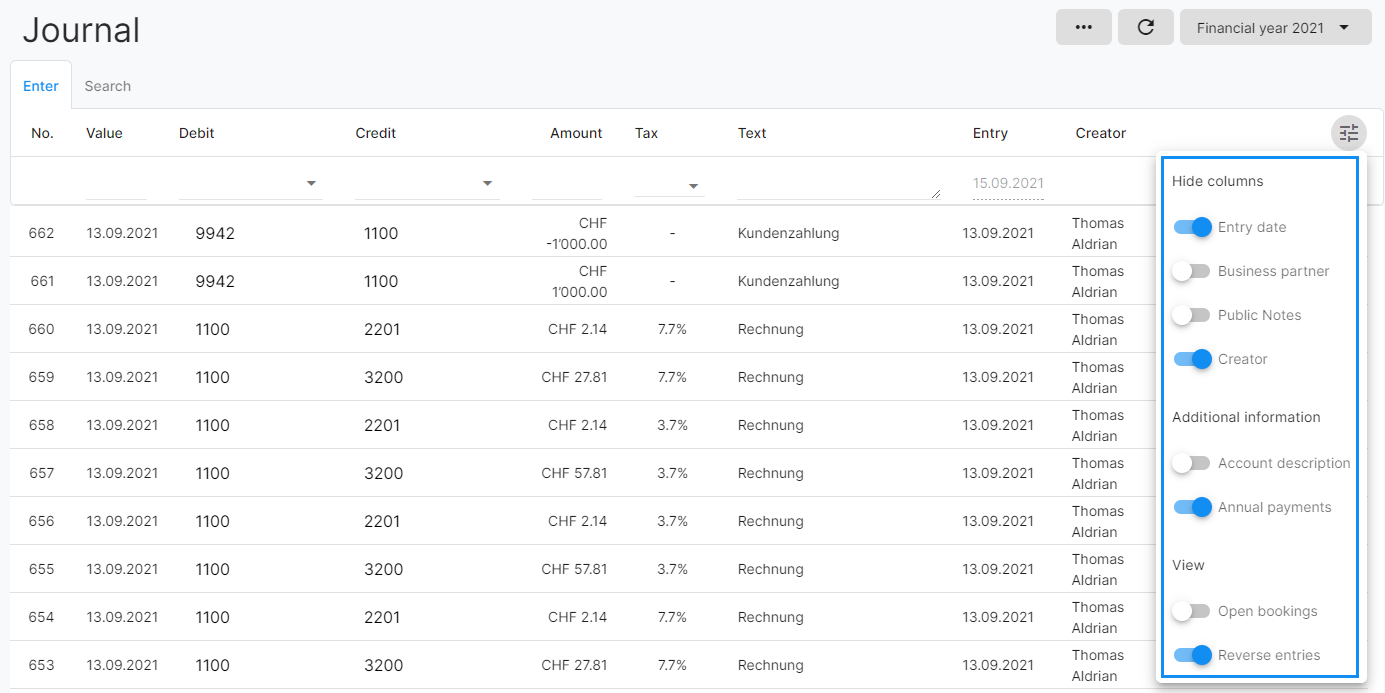

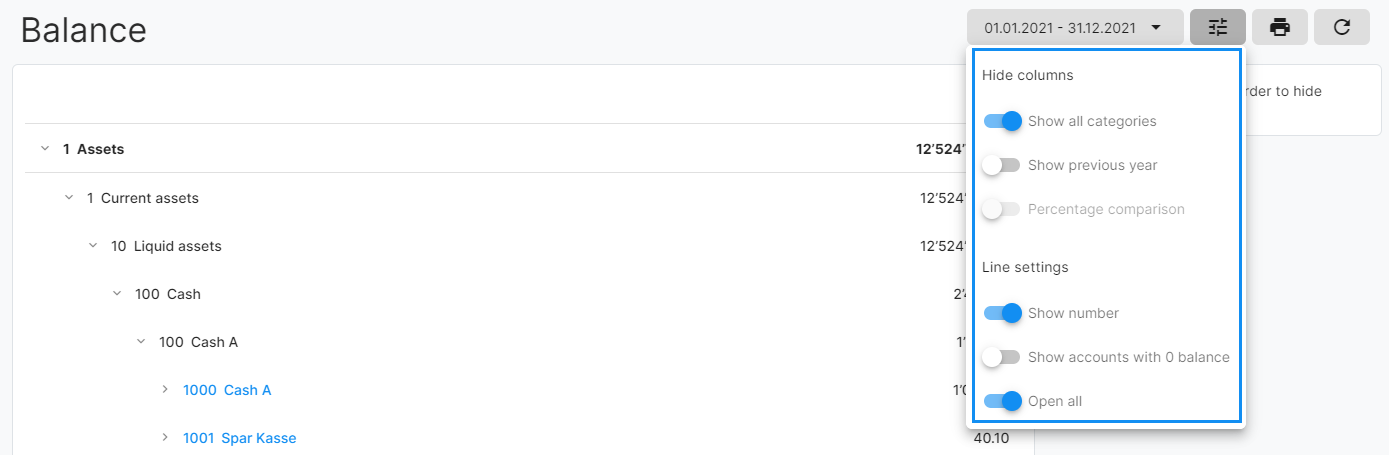

1. Persistant Settings

On lists such as the account statements, the journal, the balance sheet, etc. it is possible to make settings to the presentation. These options include, for example, whether columns should be shown or hidden, or whether accounts with a balance of 0 should be displayed.

These display options will be retained for the future and thus permanently saved for your user in the corresponding account and will no longer be reset after the end of a session. Whenever a user logs into their account, all of these display option settings will be loaded again according to the last state.

This allows you to display only the data that you really want to see when working in your account, without having to redefine the settings each time.

Dashboard

2. Time recording widget

New widgets were already made available for the dashboard with the update from 07.07.2021.

With the current update, a new widget for time recording has been added. This widget now offers the same option for time recording on the dashboard that you know from the In & Out area. You and your employees now have simplified access and can report your times directly on the dashboard.

Customers

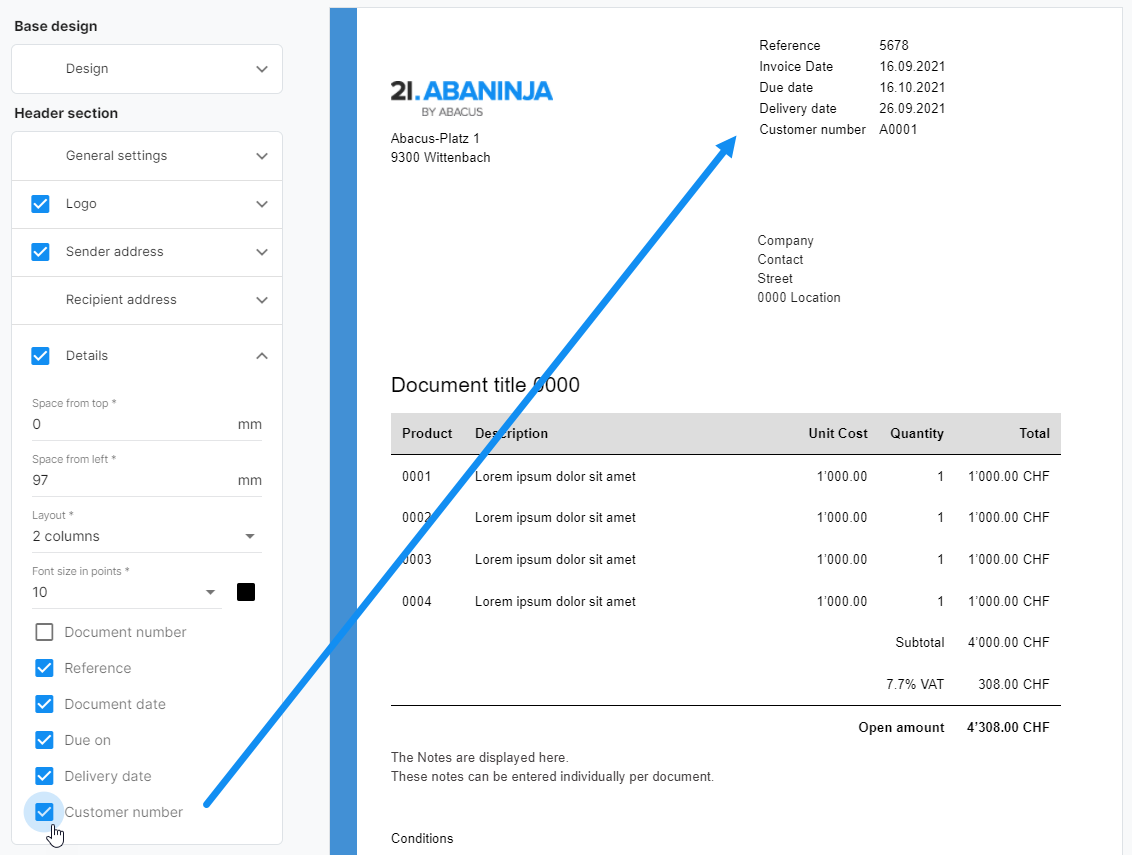

3. Address number on customer documents

In the document design it is now possible to display the address number in the header. In this way, you can send your customers documents (offers, invoices, etc.) with their customer numbers in future.

This setting is deactivated by default and can be activated under Settings > Customers > Document design > Design > Document designer > Header > Details.

Accounting

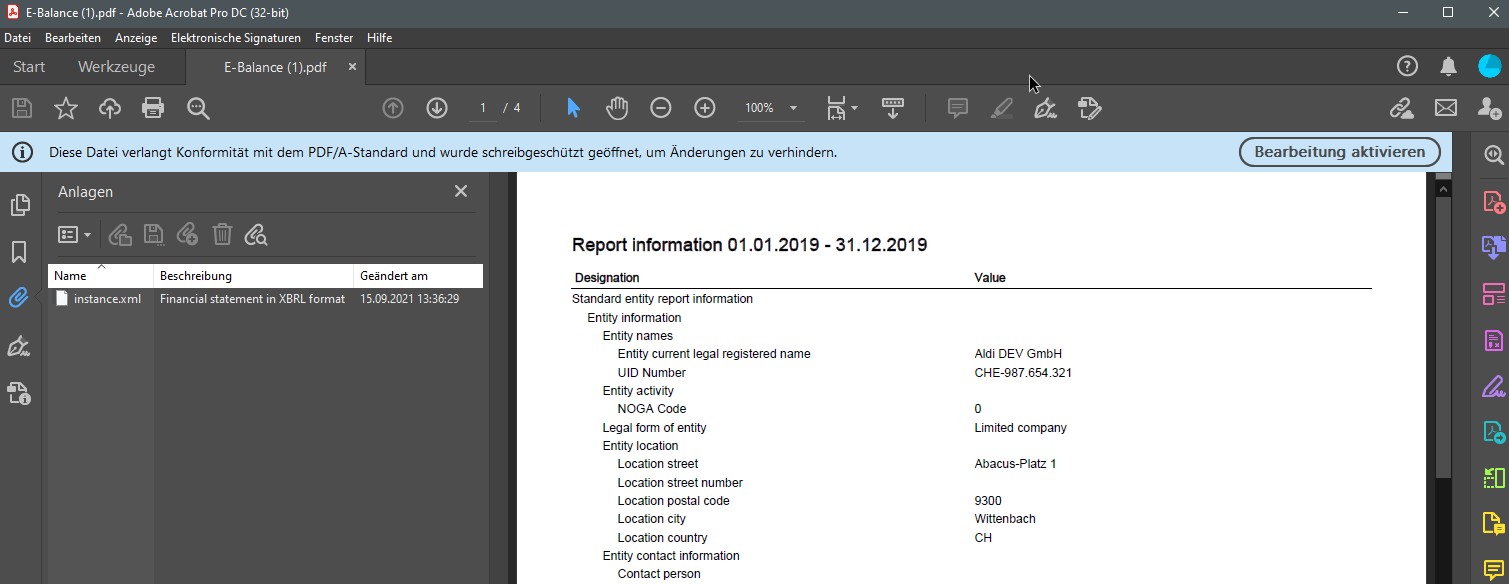

4. E-Balance sheet

Credit institutions and similar service providers often require a balance sheet in addition to data on your company. Such a so-called e-balance sheet can now, under certain conditions, be downloaded from the Balance Sheet page in AbaNinja Accounting.

Prerequisites:

- Add-on module Advanced Accounting

- The following information must be stored in the company data:

- Company ID or VAT Number

- an Industry / Branch

- The assets and liabilities must be balanced.

If the requirements are met, the Download E-Balance Sheet function is displayed on the balance sheet (Accounting > Report > Balance Sheet).

If the download is triggered, the data is prepared accordingly and a PDF is generated.

In addition, an XML file in the so-called XBRL format is added to the PDF as an attachment, which can also be processed automatically by the credit institution.

5. Fiscal year not equal to calendar year

This update enables AbaNinja financial years to have an individual term in future and no longer necessarily have to correspond to the calendar year.

However, for technical reasons and due to some dependencies, the following prerequisites and conditions apply for this.

Prerequisites:

- Add-on module Advanced Accounting or a connection to an Abacus Financial Accounting (Abacus Fiduciary).

Conditions / Information:

- Start date is always the first day of the month (e.g. 01.02.2023).

- End date is always the last day of the month (e.g. 30.04.2023).

- Two financial years cannot begin in one calendar year. Each calendar year always ends one financial year and starts another. .

- Example: 01.01.2022 to 30.06.2022 and from 01.07.2022 to XY is not possible

- The end date can only be changed for the last financial year.

- Example: Open financial years 2020, 2021 and 2022. The end date can only be changed for the 2022 financial year..

- If a new financial year is opened, it is always initially created from the end date of the previous financial year plus+12 months.

- Example: Current financial year end date 31.01.2022 / New financial year period 01.02.2022 to 31.01.2023..

- It is not possible to "shorten" a financial year if there are already entries in the "period to be shortened".

- Example: Existing financial year 01.02.2022 to 30.04.2023. Entries have already been made for April 2023. Consequently, the end date cannot be shortened to 31.03.2023.

- If a new financial year is opened, it is always initially created from the end date of the previous financial year plus+12 months.

- Example: Current financial year end date 31.01.2022 / New financial year period 01.02.2022 to 31.01.2023.

-

It is not possible to "shorten" a financial year if there are already entries in the "period to be shortened".

-

Example: Existing financial year 01.02.2022 to 30.04.2023. Entries have already been made for April 2023. Consequently, the end date cannot be shortened to 31.03.2023.

-

-

This adjustment has no effect on the VAT periods, which will continue to be based on the calendar year until further notice.

.

6. Accounting accounts: Allow or prevent manual entries

On accounting accounts it is now possible to define whether manual postings are possible on this account or not.

By default, the function is always active for all accounts (= manual entries allowed). If the function is deactivated, no manual entries can be made on the account statement or journal for the corresponding account.

This function has no influence on automatic entries (e.g. invoices or payments).

Prerequisites:

- Add-on module Advanced Accounting or a connection to an Abacus Financial Accounting (Abacus Fiduciary).

Comments

0 comments

Article is closed for comments.