In the update of December 15, 2021, enhancements and improvements were implemented in the following areas.

Summary

Video on all the new features

Settings

1. VAT settlement method: Change to quarterly

Dashboard

2. Widget: Liquidity development / Cash and cash equivalents

Customers

3. Comments function (Internal): Addresses, Customer documents & Supplier documents

Accounting

5. Account statements: Function "Export everything"

Summary

Video on all the new features

Settings

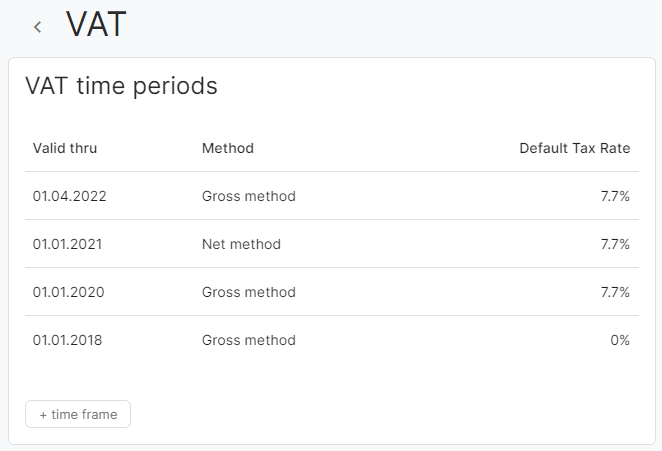

1. VAT settlement method: Change to quarterly

Until now, the VAT settlement method could only be defined for one financial year. A change was only possible if no entries were made in the corresponding financial year.

Now it is possible to create a new VAT settlement method at the beginning of a quarter. This means that the settlement method can also be changed within a financial year.

Requirements:

- The creation is only possible starting with the next quarter.

- There may be no bookings that have a value date after the start of the new time period. Example: If there are already bookings for the month of August, a new settlement method can only be defined from October - not already in July.

Dashboard

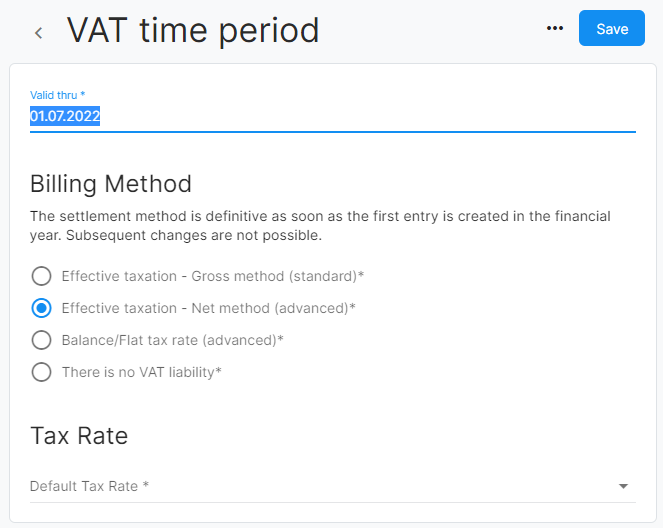

2. Widget: Liquidity development / Cash and cash equivalents

An additional Liquidity Development / Cash widget has been added to the dashboard.

The figures under Income and Expenses are calculated based on the entries to accounts in the Liquid Assets account group and the selected period. Entries where both accounts are assigned to the Liquid Assets account group are not taken into account.

Customers

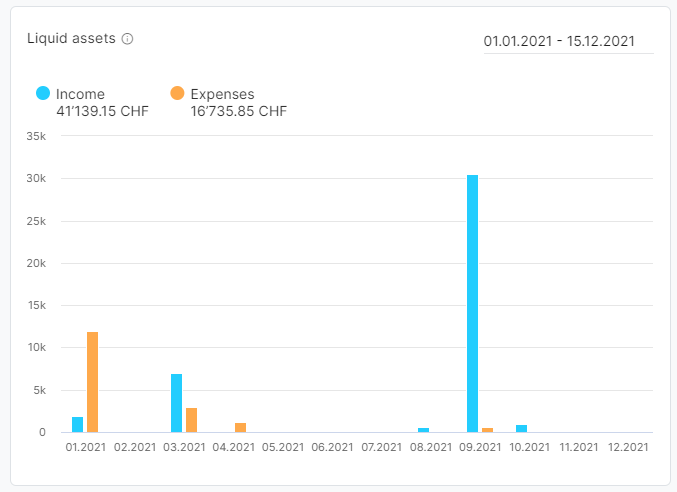

3. Comments function (Internal): Addresses, Customer documents & Supplier documents

An internal comment function has been integrated into the addresses, customer documents and supplier documents. This function makes it possible to store different and several remarks/notes.

More information:

- The comments can only be read by users within the accounts.

- Comments can only be deleted (creator or account owner) and not edited.

- The most recent comment is always at the top.

- There is no editor available for formatting.

- For customer documents and supplier documents, comments can be entered for Draft / Open status.

Note:

This function will be extended to include external comments (customer documents) at a later date. This means that it will be possible, for example, for an invoice recipient to enter a comment on an invoice in the customer portal and for this comment to be answered.

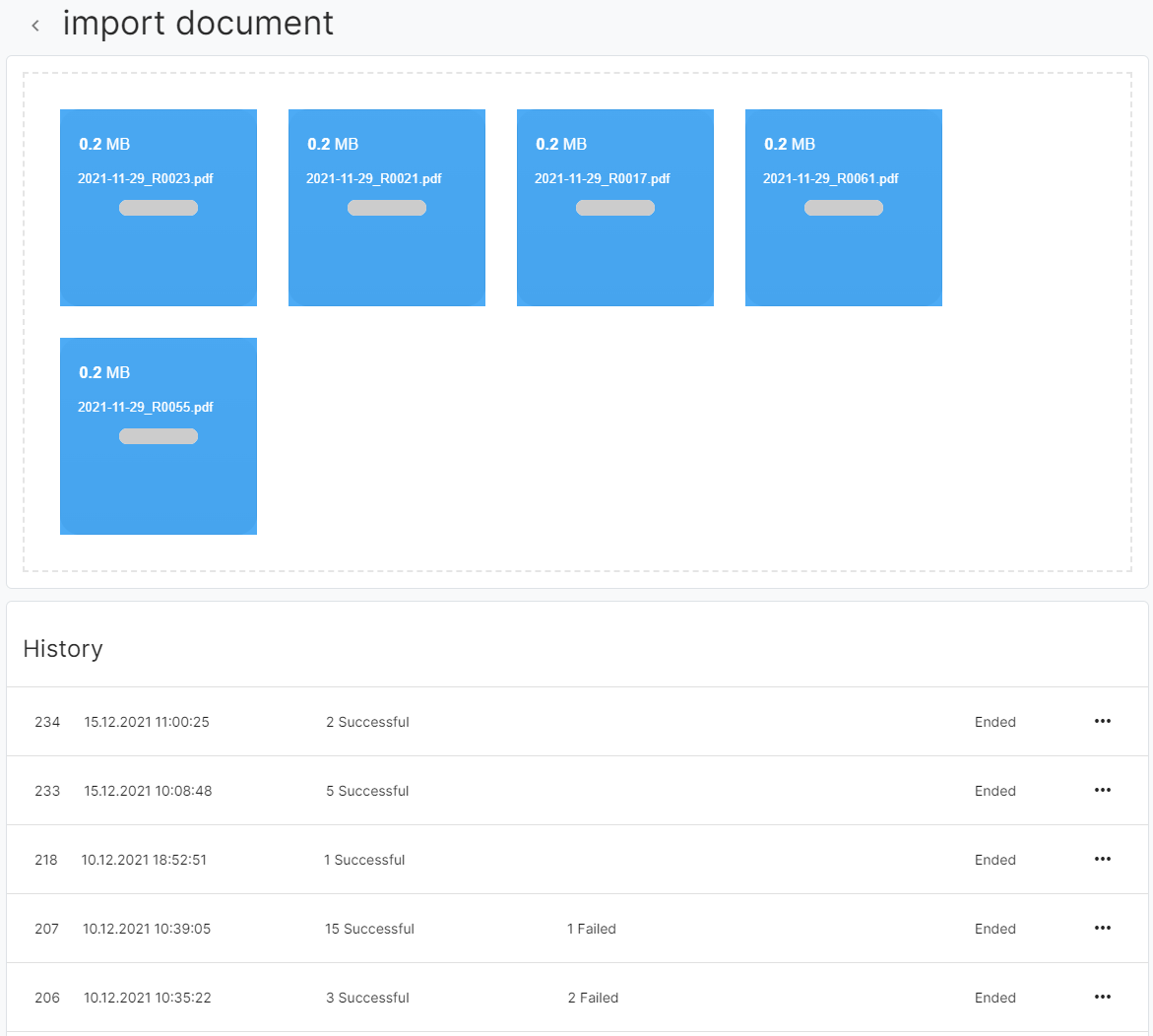

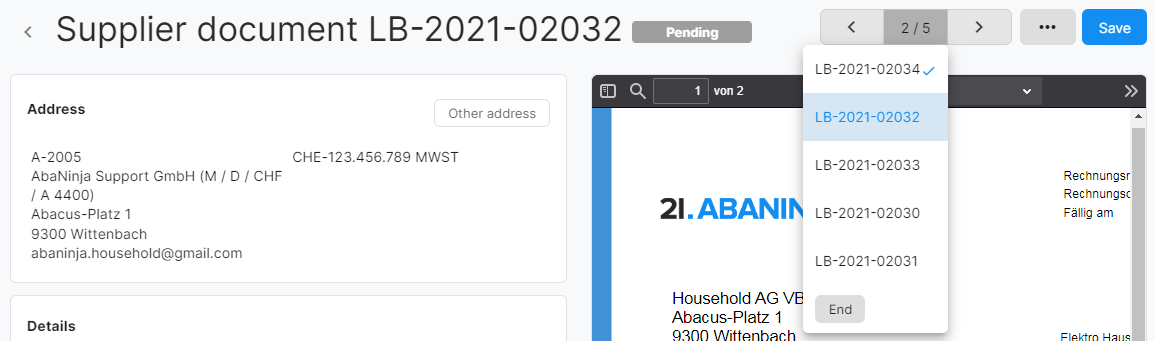

4. Mass import

When importing supplier documents or customer invoices, it is now possible to import up to 20 documents simultaneously. This should optimise and speed up the processing time.

A history is available via which the simultaneously imported documents can be accessed. The history also shows which documents were successfully imported and whether errors occurred.

The imported documents can be processed and released consecutively with batch processing without having to open each document individually.

Requirement:

- Advanced accounting add-on module or Abacus connection (AmID)

Accounting

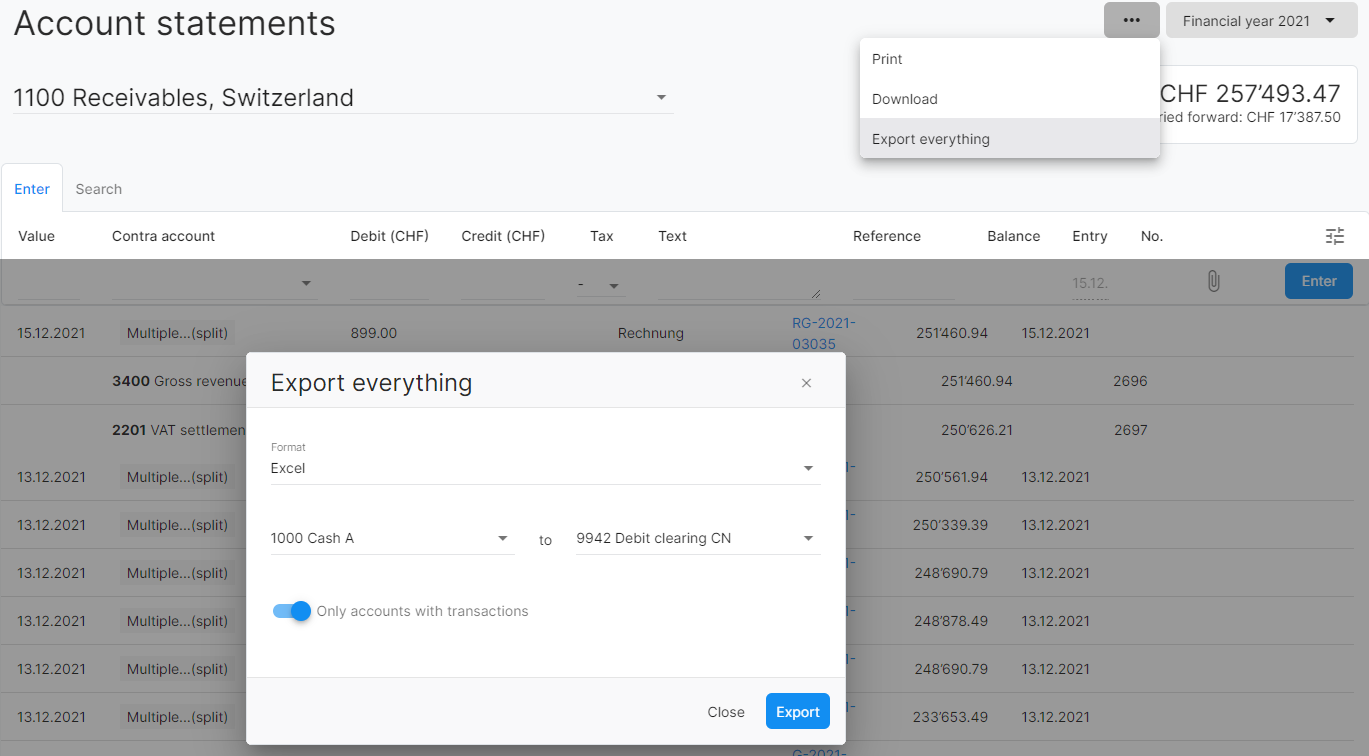

5. Account statement: Function "Export everything"

It is now possible to export several account statements at the same time.

Both the format (XLS file or PDF) and the account range from/to can be selected. In addition, you can choose whether the export should only be made for accounts with transactions or not.

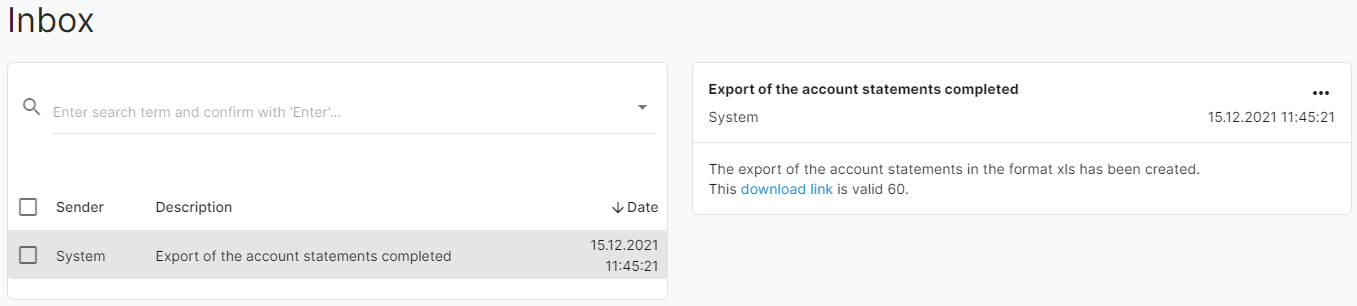

The export will be executed in the background and will then be available for download in the Inbox.

Requirements:

- Advanced accounting add-on module or Abacus connection (AmID)

Comments

0 comments

Article is closed for comments.